A new pricing model of China’s parallel rail lines under the diversified property rights

Shaoni Zhou, Qiusheng Zhang, Xiaowei Wu

Beijing Jiaotong University (China)

Received November 2012

Accepted February 2013

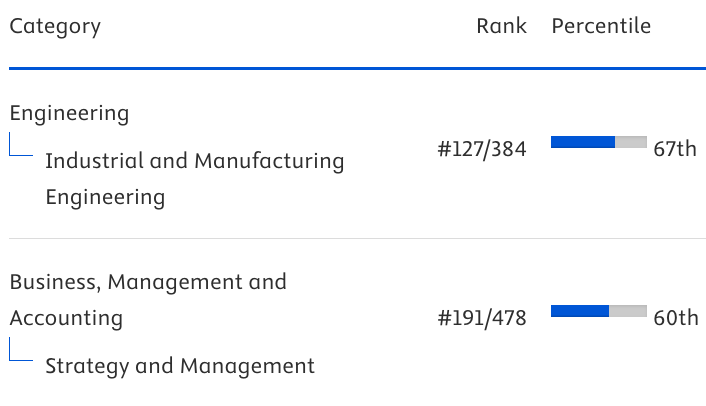

Zhou, S., Zhang, Q., & Wu, X (2013). A new pricing model of China’s parallel rail lines under the diversified property rights. Journal of Industrial Engineering and Management, 6(1), 135-148. http://dx.doi.org/10.3926/jiem.591

---------------------

Abstract:

Purpose: The purpose of this paper is to study on the pricing of China railway company under the background of diversified property rights, especially the pricing of the parallel line system that belong to different owners.

Design/methodology/approach: Through theoretical analysis of the main influential factors of railway pricing, this paper designs a basic quotation system for the parallel railway lines.

Findings: The transaction price of parallel line consists of two parts, which are fixed railway network price and variable network using price.

Practical implications: Through the reasonable designing of fixed network price and variable network using price, it can not only lead to high profitability and low government subsidy, but also can ensure remaining more railway network resources and fulfill the social responsibilities.

Originality/value: The conclusions of this study will lay the foundation for the harmonious development of Chinese railway network under the diversified property rights.

Keywords: Diversified Property Rights, Parallel Rail Lines, Pricing Model

---------------------

1. Introduction

According to the medium-term and long-term railway adjusting project, a rapid growth will last in the nationwide railway network in the next decade. The transport capacity will meet the needs of economic and social development, and the key technology and equipment will reach or close to the international advanced level. Such a large scale of investment will inevitably need to further expand the scale of the joint venture in rail construction, and the diversified property rights has become an inevitable trend. In the period of which the railways were entirely belonged to the state, the cost of the rail network is seen as internal costs and without independent accounting. While under the background of diversified rail network ownership, the pricing of the rail network affects not only the income and cost of the rail infrastructure enterprises and transportation enterprises, but also the competition and cooperation of the different rail infrastructure companies. Most of all, because the parallel lines which belong to different owners provide similar service which can be easily substituted, competitions will arise between different producers. It is urgent to solve the problem of how to realize fair competition for the national railway and joint venture railway. Based on these preconditions, this paper will study on the pricing model of using fees under the situation of diversified property rights.

2. Practices of the rail network pricing and relevant literatures review

2.1. Rail network pricing practice around the world

In America, the railroad system is mainly used to undertake the freight, thus most of the railway companies are freight companies, which railway lines have taken up a high proportion of the current U.S. business lines. As a result, the problem is that the passenger transport companies should pay for the using of the railway which owned by the freight transport company. In determining the cost compensation for rail network, it mainly reflects the idea of subsidy-free pricing. That is, the transport facility users should compensate for the full cost. There is no obligation for the government to offer subsidy to infrastructure construction and its operation. In the actual market, the charge on the cross-road transportation is determined by daily negotiations.

In European rail network pricing practice,

different methods

are adopted in various countries: in the Nordic countries (Sweden,

Finland,

Denmark, etc.), the rail network charge is based on marginal cost; in

Germany

and France, it is based on the average cost. Since the marginal

cost-based

charge is usually lower than that of average cost-based, the Nordic

country

governments need to provide a lot of subsidy for the rail network

companies.

Chinese railways have been fully owned by the

state for a

long time. The Ministry of Railways acts as both a government

department to

implement the national rail management function and a market player to

provide

complete rail transportation products. In financial practice, the

Ministry of

Railways also works as an accounting body as a whole, therefore the

rail

network fees become an internal transaction costs and cannot be defined

clearly. Based on this, the rail network fees, having been “digested”

within

the railway system for a long-term, had been ignored for a long time.

In 2001,

railways began to implement the policy of "separation of rail network

and

transportation" internally and split accounting system between

passenger

and freight companies, which led to the passenger transportation

entering the

rail charging system. In this system, the standards of the rail line

using fees

is formulated by the Ministry of Railways according to the train

kilometers,

taking into consideration of the line class, the train grade and

grouping size.

2.2. Relevant

literatures

review

There have been many literatures on properties, property of railway enterprises and property theory in railway pricing practice.

Coase studies property and points out that private enterprises are more efficient than state enterprises in resources allocation (Coase, 1960). Wang Engui and Wang Jiaqiong address an idea in their paper that Chinese government should speed up the structural reform of railway investment, amend the railway law, guarantee law, corporation law, taxation law and other related laws, and make particular privilege policies and clean off the legal impediments in railway construction for non-governmental capital in China, to solve the problem of capital scarcity and offer another investment opportunity for non-governmental capital in China (Engui & Jiaqiong, 2003).

Although the Ministry of Railways has begun to encourage the non-governmental capital to invest in railway construction, the effect is not obvious in practice. In order to find out the reason for this phenomenon, Rong Chaohe has given his opinion that railway investment and financing system should not only focus on the financing level, but also should challenge the old system formation of government-control (Chaohe, 2006). Liu Xia attributes this to the current system arrangement in railway. She thinks that the Railway Bureau can easily invade the benefits of the joint-venture enterprise (Xia, 2007). Li Wenxin, Liang Fang & Shi Benshan give their points of that the Railway Bureau would select “locked-in” as the most excellent strategy after the social capital invested in the railway construction, so what the external capital can do is only to reject investing in the railway construction (Wenxin, Fang & Benshan, 2010).

Zhao Jian believes that traffic flow regulation right is the most important element of railway property (Jian, 2007). Li Minghui and Zhao Jian also point out that the real reason for the external capital investors to leave the railway market is that they cannot share the synergy value (Minghui & Jian, 2008).

On railway pricing method, Li Daian thinks that the railway network facilities are public goods, so the government should pay for the cost of the goods (Daian, 2006). Francisco C. & Juan D. O., Henrik A. & Mikael O. also suggest that the railway pricing should connect with the cost, while presently, only a small portion of costs are recovered via charges (Francisco & Juan, 2011), (Henrik & Mikael, 2007). Christina N., Zhang Hanbin & Tan Yan, Qian Chunyan etc. study the railway charging method in different countries and areas (Christina, 2008), (Hanbin & Yan, 2011), (Chunyan, 2010). Besides these, there are still some literatures on models of travel route selection. For example, Li Mi etc. and ZHU Xiaodong etc., suggest such models, but they are mainly on urban traffic (Mi, 2011), (Xiaodong, 2012).

Based on these literatures, this paper will try to give some suggestions on fair competition of the parallel railway by different capital sources from different pricing model.

3. Basic relationship of the rail network pricing under the background of the diversified property rights

Both the European rails complete separation of

network and

transportation and the American Rails incomplete separation, their rail

management systems are both in a mature market economy.

The railway development has led to strong financing needs, and the scale of the joint ventures will be further expanded. Correspondingly, Chinese rail network pricing also needs to establish a market pricing mechanism which can adapt to the overall requirements of railway diversified ownership and can properly handle the relationship among different stakeholders.

Under the diversified property rights of Chinese rail network, rail networking quoting stakeholders can be divided into three hierarchies. Their relationships are shown in Figure 1.

The first level is the Ministry of Railways, whose goal is focused on the national railway development, and at the same time, reducing the level of financial subsidies as much as possible; the second level is the railroad bureau and outside investors. The goal of the Railway Bureau is the completion of the performance evaluation of the Ministry of Railways and the transport task, while external investors pursue gain a higher rate of return on the investment; the third level includes the state-owned rail companies, the joint venture rail companies and transportation companies. The rail companies’ goal is to improve the supply efficiency level of the rail network resources, while the transportation companies’ goal is to obtain the largest benefits from the rail network resource through negotiations with the rail network service provider.

Figure 1. Stakeholders in Rail Network Pricing

Therefore, the pricing mechanism of the rail network under the diversified ownership really impacts these stakeholders and must emphasize their interests. The reasons are as follows:

Firstly, as the sellers of network resources who

provide

similar displacements services,

the

state-owned railways and joint-venture

railways should make decision independently and develop a

competitive quoting

system which will help to improve the service level and control costs

of

railway companies.

Secondly, transportation companies act as the buyer of rail network resources, should have an independent bargaining rights and the ability to seek the lowest bid seller of rail network resources.

Thirdly, the Ministry of Railways will strive to reduce the level of subsidy which may be only given to the railway network company, for which there is more cost sank relative to other transportation companies.

Fourthly, being a rational investment entity, the

external

capital will investigate the income of the rail network and the

government

subsidies when making the decision of investing to the railway line. If

the

realized return overweighs the cost of the investment, the investors

would

choose to invest. Otherwise, they will give up.

4. Analysis of the influential factor of the rail network pricing

4.1. Cost factor

The price of any goods or services can be regarded

as

compensation of its cost in transaction. The more we consume social

resources,

the higher price of goods and services it should have. Otherwise there

will be

no manufacturers or service providers.

Taking into account the actual situation of

Chinese railway

development, the cost of the rail network can be defined into the

following

five levels. First: the variable operating cost of the rail network;

Second:

the variable and fixed operating cost of the rail network (excluding

the interest expense); Third: the full operation

cost of

the rail network; Fourth: the full operation and construction costs of

the rail

network; Fifth: the full operation and construction costs of the rail

network

and the equity cost of it.

Figure 2. Level Graph of Rail Network Cost

The fourth level is the traditional accounting cost and the fifth level is the economic cost.

4.2. Supply and demand factors

The supply-demand relationship is referred to the relationship between production and consumption in the market. In private market economy, the deviation of price from value spontaneously adjusts supply and demand. If supply exceeds demand, prices will decrease; if demand exceeds supply, prices will increase.

The rail network resource is a special service

whose supplier

is the railway infrastructure company and the consumer is the railway

passenger

and freight transport company. Its supply-demand relationship is

influenced not

only by very two sides, but also by external factors, such as the

redundancy

degree of social capital, the average profit margins of society, limits

on the

prices and subsidies from government.

4.3. Government

factor

In actual economic environment, expect for the

invisible

hand of the market, there is also the visible hand of the government.

Especially when the natural monopoly characteristics of public goods

are

involved, the government's actions will largely affect the price of

services

and investor returns. Government’s influences on rail services are

reflected in

the following two aspects.

First, the government can set the price of transport services. The government always controls the price by providing the highest price or lowest price regulation, thereby affecting the market demand and the relationship between demand and supply.

Second, the government can implement the price

subsidies.

For public goods, the government always consider the maximize

efficiency of the

entire socio-economic by providing subsidies. The extent of subsidies

is

usually determined by the degree of cost compensation.

5. The pricing

model of the

parallel rail lines

The pricing model should be in line with market mechanism and suitable

for the

parallel rail lines.

5.1. Specific

conditions of

the pricing model

The model should possess the following basic

conditions when

applied to the parallel rail line.

Firstly, the rail network service providers are state-owned railways and joint-venture railways, and there are a large number of rail network service buyers.

Secondly, there are two forms to purchase the rail

network

resources. The first is the negotiation at a fixed time that the buyers

buy the

rail network services based on forecast of future transport demand for

a fixed period;

the second is temporary negotiations that the buyers buy the rail

network

services according to the provisional transport plan which will be more

expensive because it requires the rail network providers to provide

temporary

marshalling and deployment of network resources and will not be

investigated

further in this article.

Thirdly, the fixed period purchase price includes

two parts:

one is in the form of rail network card, which is a fixed cost and

provides the

buyer the right of using the network in the range of a certain passage;

another

part is in the form of user fees, which is a variable costs by paying

the

network usage fees according to the actual mileage, speed, load and the

rail

grade.

5.2. Construction of the pricing model

The pricing mechanism

The state-owned railway and the joint venture

railway both

proposed their rail network card price, which are w1 and w2,

and rates of fee for per unit are ω1 and ω2. The

card

price of the state-owned rail network is lower than that of the joint

venture

rail network, that is w1< w2 , but the rates

of fee for per unit of the state-owned rail is higher than that of the

joint venture rail, that is ω1>ω2. These will

produce the equilibrium point of the train traffic volume in the

transaction of the railway

resources. That is, when the train traffic

volume is on this point, the transaction price of the rail resources is

the

same no matter one chooses the state-owned rail or the joint venture

rail, when

it comes to the actual train traffic volume, it is cheaper to choose

the joint

venture rail, on the contrary, it

is cheaper

to choose the state-owned railway. Those are shown in figure 3 below.

The

equilibrium point is

Figure 3. Offering Mechanisms of Network Resources

This quotation mechanism has three notable characteristics which will be shown in the following part.

Firstly, the quotation mechanism of the rail

network trading

price can be divided into two parts, which are the fixed card price and

the

variable fee of using rail network, which can be understood as that the

fixed

card price is the compensation for the rail infrastructure costs of and

the

fixed operating costs, and the variable use fee part is the

compensation for

the variable operating costs. These reflects the fact that different

income

corresponds to different costs, and this division can give a more clear

definition of the degree of compensation for different nature of costs,

thus

provide a reasonable reference when formulating the subsidies mechanism

for the

government.

Secondly, this quotation system encourages the

company with more

train traffic to choose the joint-venture railways. Because the joint

venture

rail network resources can be utilized more efficiently and the actual

profitability can be improved then, which will attract more external

capital

investment on the railways as well.

Thirdly, this quotation system makes the

state-owned railway

have more remaining rail network resources and can satisfy the

temporary

transport demand. In this way, when there is a temporary emergency

situation,

such as earthquake relief, which needs rail transport, it can be

realized by

using the state-owned railway resources. The social responsibility of

the

state-owned railway can be completed without sacrificing the interests

of the

joint venture railways.

Subsidy mechanism

As the quotation system described above, the rail transport companies can be divided into two categories, one is those choosing the state-owned rail network resources, with a total number of m, each traffic amount isα1,I (i=1…m), the other is those choosing the joint-venture rail network resources, with a total number of n, each traffic amount is α2,j (j=1…n).

The annual income of the state-owned railway is:

Supposing the service life of the state-owned railway and the joint-venture railway is M and N, the total income of the state-owned railway is:

c2 represents the cost per transportation volume.

For the state-owned railway, the fixed operating cost (excluding the interest cost) is OC1, the annual interest cost is FI1, and the fixed investment on the rail network construction is FC1; for the joint-venture railway, the fixed operating cost (excluding the interest cost) is OC2, the annual interest cost is FI2, and the fixed investment on the rail network construction is FC2.

The total cost of the state-owned railway is:

Under the circumstance of no expansion of production, the government subsidy to the state-owned railway and the joint-venture railway are s1 and s2 respectively, the average social profit margins is r, the external equity investment of the joint-venture railway is g, so the goal of the governmental subsidy is:

In this equation, VS1 and FS1

are

referred to the variable cost subsidy and the fixed cost subsidy

respectively.

It can be calculated that the variable cost subsidy rate is for

state-owned railway

companies, the

government

subsidy rate is

; the fixed cost subsidy is

,

the government

subsidy rate is

.

In the above equation, VS2 and FS2

are

represented variable cost subsidy and the fixed cost subsidy

respectively. It

can be calculated that the variable cost subsidy rate is for

the railway joint venture

companies, the government subsidy rate is

;

the compensation rate for the fixed cost

and economic profit is

, the government compensation rate

is

.

5.3. Evaluation on this pricing model

Function of government

In the basic model, the government needs to find the equilibrium point in a certain way, in order to determine the transport volume in the quotation system, which is an important factor to the operating income for both the state-owned railways and joint-venture railways, thereby affecting the government actual subsidy level. It would be a better operation mode for the joint-venture railway that the rail network card price w2 and the unit charge ω2 can be decided though improving modern corporate governance structure. While, the state-owned railway can determines the unit charges ω1 according to its variable costs. The government sets the price of state-owned rail network card w1 according to the forecasted total social demand between the two service nodes.

In addition, government can attract more external

capital

investment by choosing the investment event with high level of incomes,

which

will not only reduces the level of government subsidies S2,

but also increases the market competitiveness of joint-venture railways.

Time factor

In the basic model, the quotation mechanism is once a year and the rail transport company will select the rail network company based on the needs of the next year's transportation. But this does not take this case into account, that is, the annual demand for transport is not distributed equally to each month, but with a certain periodicity. From this perspective, if the frequency of quotation mechanisms is higher, such as once a month, it would be more reasonable. However, it will also increase the total negotiation cost if the offer mechanism is too often.

Confirming of the average social profit margin

In the basic model, an important exogenous variable is the average social profit margin. On the one hand, it is an opportunity cost for external capital. If the profit margin of investment in the railway is lower than the average social profit margin, the railway is not worth investing. On the other hand, it is the key factor to decide whether the government should give subsidy to the joint venture railway and how much to give.

Problems of forecast accuracy

The most important decision that the Ministry of Railways has to make is to give the state-owned rail network card price and the equilibrium point of transport volume based on the future transport demand forecast, the rail network card price w2 and the unit charges ω2 of the joint-venture, the state-owned railway unit charge ω1. By the transport company’s choice, the total social transport demand between the two service nodes can be distributed spontaneously. Ideally, the passenger or freight transport company which has a large requirement should choose the joint-venture railway, and the company of passenger or freight transport which has a small requirement should choose the state-owned railway. Therefore, in order to let the market’s selection to be well-ordered, there is a higher requirement on the forecast accuracy of future transport demand. Methods to improve the prediction accuracy include the following two, but not limited to them: the first is the trial offering system, that is before the formal rail network bidding, there is a process to ask price, and then work as the reaction of the market to the process of formal network quotations; the second method is to raise the frequency of offering mechanism, such as once a month, which can improve the accuracy of the forecast in a certain extent.

Rail network card pricing method

The price of the rail network card can be further considered from two perspectives. On the one hand, we can learn from the practice of the European rail network reform and development. Different levels of price should be established according to the rail line grade, and the train level. This is also in line with the basic value law that the more network resources on one consuming, the more one should pay and the higher the rail network card price is) ; on the other hand, we can set the rail network card price according to the different transport volume of the rail transportation company. This is more in line with the economics of differential pricing, that is, the full access to consumer surplus, consumers here is the rail transportation company. For producers, such as the state-owned rail network company and the joint-venture rail network company, the meaning is to obtain the consumer surplus as much as possible and reduce government subsidies and the government participation in market activities.

6. Conclusions

It is a corollary that the financing bottleneck of

the

railway development decides the diversification of China's railway

investment

entities. In order to attract the external capital investors to invest

in the

railway construction, the mode of operation led by the existing

Ministry of

Railways must be changed, and it is necessary to establish the

market-oriented

pricing mechanism of the rail network.

Firstly, this paper has analyzed the stakeholders and their relationships under the rail network pricing of the diversified property, and designs a clear mechanism of competitive quotation among the sellers, and the buyers should have an independent bargaining rights and negotiation capacity. Based on the above conditions, the Ministry of Railways can reduce subsidies to the rail network companies.

Secondly, this paper has analyzed the main

influencing

factors of the rail network pricing, which include cost factors, demand

and

supply factors and government factors.

Finally, this paper has constructed the basic

pricing model

for parallel rail lines, defined the specific conditions of the model

from the aspects

of the characteristics of the transaction parties, the transaction

formation

and the composition of the price, and also made explanations of the

basic model

from the perspective of pricing mechanisms and subsidy mechanisms.

References

Chaohe, R.

(2006). Boosting railway

investment institutional reform in China from property relations. Comprehensive

Transportation, 1, 32-36.

Christina, N. (2008). User charges for the railway infrastructure in Bulgaria, Transportation Research Part A. Policy and Practice, 42(3), 487-502. http://dx.doi.org/10.1016/j.tra.2008.01.015

Chunyan, Q., Fang, W., & Zhicheng, L. (2010). Price discrimination method and its use in railway transport of passenger. Railway Operation Technology, 1, 16-20.

Coase, R.H. (1960). The problem of social cost. Journal of Law and Economics, 3(10), 1-44. http://dx.doi.org/10.1086/466560

Daian, L. (2006). Research on the pricing problems of the railway infrastructure. Comprehensive Transportation, 7, 36-39.

Engui, W., & Jiaqiong, W. (2003). Legal impediments of non-governmental capital participating in rail way construction in China. Journal of Northern Jiaotong University (Social Sciences Edition), 2(3), 15-19.

Francisco, C., & Juan, D. (2012). Are rail charges connected to costs. Journal of Transport Geography, 22(5), 28-33.

Hanbin, Z., & Yan, T. (2011). Railway rate regulation in America and its enlightenment on our country. Rail Way Transport and Economy, 11, 49-52.

Henrik, A., & Mikael, O. (2007). Noise charges in railway infrastructure: A pricing schedule based on the marginal cost principle. Transport Policy, 14(3), 204-213. http://dx.doi.org/10.1016/j.tranpol.2007.01.002

Jing, H. (2008). Railway infrastructure pricing in Europe. Chinese Railways, 12, 55-59.

Jian, Z. (2007). Relationship among the united schedule, the railway property and the transportation efficiency. Comprehensive Transportation, 11, 13-17.

Mi, L., Xia, W., & Xianjun, G. (2011). Travel route model under traffic congestion environment based on reliability, AISS, 3(8), 179-185. http://dx.doi.org/10.4156/aiss.vol3.issue8.22

Minghui, L., & Jian, Z. (2008). Synergy value: Crucial reason for difficulty of railway investing and financing in China. Comprehensive Transportation, 5, 9-14.

Wenxin, L., Liang, F., & Benshan, S. (2010). Analysis based on the financing difficulties of locked-in joint-venture railway. Journal of Southwest Jiaotong University (Social Sciences), 2, 53-55.

Xiaodong, Z., Hongcheng, G., Chen, L., & Chongjun, F. (2012). Modeling traffic model driven route choice simulator in UML, JDCTA, 6(5), 141-149. http://dx.doi.org/10.4156/jdcta.vol6.issue5.17

This work is licensed under a Creative Commons Attribution 4.0 International License

Journal of Industrial Engineering and Management, 2008-2026

Online ISSN: 2013-0953; Print ISSN: 2013-8423; Online DL: B-28744-2008

Publisher: OmniaScience