Network structure detection and analysis of Shanghai stock market

Abstract

Purpose: In order to investigate community structure of the component stocks of SSE (Shanghai Stock Exchange) 180-index, a stock correlation network is built to find the intra-community and inter-community relationship.

Design/methodology/approach: The stock correlation network is built taking the vertices as stocks and edges as correlation coefficients of logarithm returns of stock price. It is built as undirected weighted at first. GN algorithm is selected to detect community structure after transferring the network into un-weighted with different thresholds.

Findings: The result of the network community structure analysis shows that the stock market has obvious industrial characteristics. Most of the stocks in the same industry or in the same supply chain are assigned to the same community. The correlation of the internal stock prices’ fluctuation is closer than in different communities. The result of community structure detection also reflects correlations among different industries.

Originality/value: Based on the analysis of the community structure in Shanghai stock market, the result reflects some industrial characteristics, which has reference value to relationship among industries or sub-sectors of listed companies.

Keywords

Full Text:

PDFDOI: https://doi.org/10.3926/jiem.1314

This work is licensed under a Creative Commons Attribution 4.0 International License

Journal of Industrial Engineering and Management, 2008-2026

Online ISSN: 2013-0953; Print ISSN: 2013-8423; Online DL: B-28744-2008

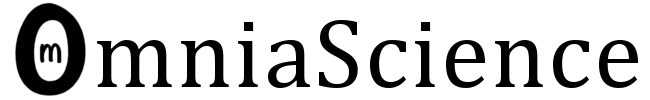

Publisher: OmniaScience