Optimal decisions of countries with carbon tax and carbon tariff

Abstract

Purpose: Reducing carbon emission has been the core problem of controlling global warming and climate deterioration recently. This paper focuses on the optimal carbon taxation policy levied by countries and the impact on firms’ optimal production decisions.

Design/methodology/approach: This paper uses a two-stage game theory model to analyze the impact of carbon tariff and tax. Numerical simulation is used to supplement the theoretical analysis.

Findings: Results derived from the paper indicate that the demand in an unstable market is significantly affected by environmental damage level. Carbon tariff is a policy-oriented tax while the carbon tax is a market-oriented one. Comprehensive carbon taxation policy benefit developed countries and basic policy is more suitable for developing countries.

Research limitations/implications: In this research, we do not consider random demand and asymmetric information, which may not well suited the reality.

Originality/value: This work provides a different perspective in analyzing the impact of carbon tax and tariff. It is the first study to consider two consuming market and the strategic game between two countries. Different international status of countries considered in the paper is also a unique point.

Keywords

Full Text:

PDFDOI: https://doi.org/10.3926/jiem.1506

This work is licensed under a Creative Commons Attribution 4.0 International License

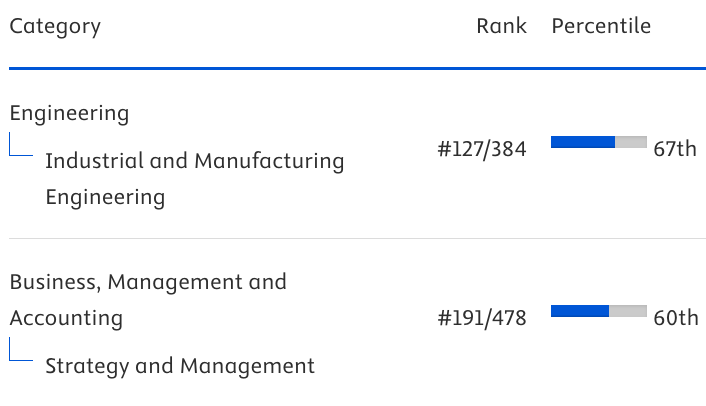

Journal of Industrial Engineering and Management, 2008-2026

Online ISSN: 2013-0953; Print ISSN: 2013-8423; Online DL: B-28744-2008

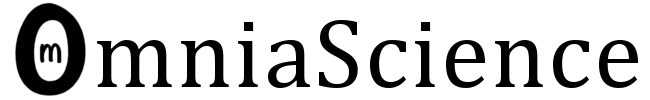

Publisher: OmniaScience